2025 remains an evolutionary year in cryptocurrency trading, with the likes of Crypto30x.com and Gemini exchange serving different purposes in the digital asset ecosystem. The following is a detailed guide

2025 remains an evolutionary year in cryptocurrency trading, with the likes of Crypto30x.com and Gemini exchange serving different purposes in the digital asset ecosystem. The following is a detailed guide to how these platforms operate, their recent developments, and what traders need to know prior to investment.

What is Crypto30x.com, and How Does It Work?

Crypto30x.com describes itself as a cryptocurrency trading signals platform that is in the business of helping traders find growth opportunities in the world of digital assets. AI-driven analytics is believed to enable the platform to provide real-time trading signals, leveraging technical analysis, on-chain data, and market sentiment tracking. The platform reportedly provides leveraged trading capability and educative resources for both beginner and experienced traders.

It refers to itself as a means of identifying cryptocurrency investments that could yield 30x returns, hence the name. The Beginner's Guide to Crypto30x.com contains information on main platform features, risk factors, and best practices of safe trading, therefore helping new users act in a responsible way in the cryptocurrency market. However, independent reviews raise a number of concerns regarding its credibility, transparency, and regulatory status. It is recommended that users exercise caution with this website and conduct due diligence as they normally would.

Overview of Gemini Exchange and Recent Developments

Founded in 2014 as a cryptocurrency exchange and custodian, Gemini was the first company in the world licensed by the New York DFS under its Limited Purpose Trust Charter, making it subject to banking compliance standards and capital reserve requirements. The company was founded by Cameron and Tyler Winklevoss.

Key Gemini Statistics for 2025

| Metric | Value |

|---|---|

| Monthly Transacting Users | 523,000 |

| Assets Under Custody | $18.2 billion |

| Lifetime Trading Volume | $285 billion |

| H1 2025 Trading Volume | $24.8 billion |

| Countries Served | 60+ |

| Supported Cryptocurrencies | 70+ |

Gemini Smart Wallet Launch August

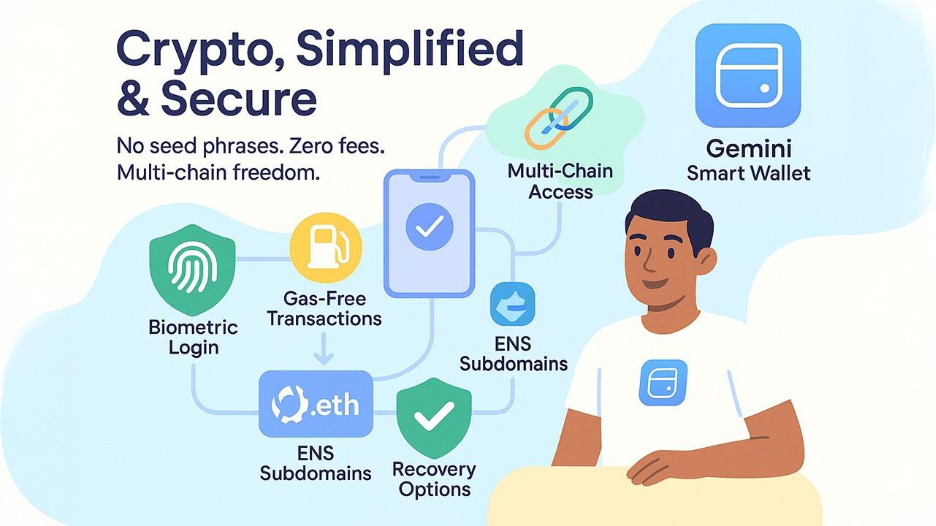

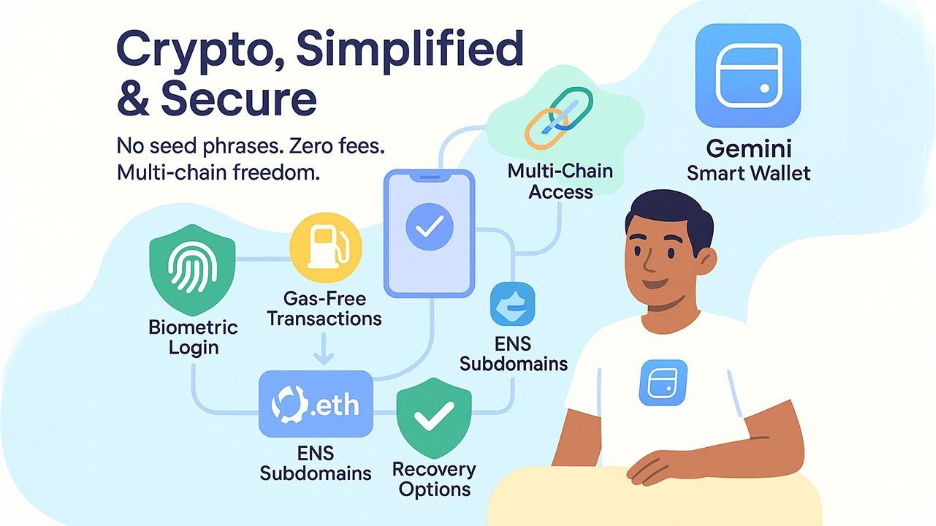

The Smart Wallet introduces a number of innovative features that make it special compared with traditional cryptocurrency wallets:

- No Seed Phrases Needed: Instead, the wallet uses passkeys and biometric authentication - FaceID or TouchID - instead of traditional 12-24-word seed phrases, removing one of the biggest security vulnerabilities whereby users could lose access to their money if their seed phrase gets stolen or lost.

- Zero Gas Fees: Gemini subsidizes the gas fees for select chain transactions, like Ethereum mainnet, Arbitrum, Optimism, Base, and Polygon, for core DeFi actions to lower barriers to entry.

- Free ENS subdomains: The user gets a free .gemini.eth subdomain, a human-readable address for transactions and on-chain identity.

- Recovery employs a variety of techniques that can restore accounts without requiring seed phrases, instead leveraging the wallet's built-in privacy-preserving recovery mechanisms as the first port of call.

- Multi-chain support allows users to use their wallets across many different chains, such as Ethereum and all of its associated L2 solutions, which allows greater ease of use when interacting with decentralized applications (dApps).

- No need to download any separate applications; the wallet can be accessed via a standard web browser on your device for added security through device-side signing.

Gemini's European Expansion with the MiCA License

Gemini received a Markets in Crypto-Assets license from the Malta Financial Services Authority on August 21, 2025. This regulatory green light is a key accomplishment in further developing Gemini's strategy for European expansion.

Impact of MiCA License

| Benefit | Description |

|---|---|

| European Market Access | Services can be offered across all 27 EU member states plus additional EEA countries |

| Regulatory Passporting | Single license enables operations across multiple European jurisdictions |

| Institutional Trust | MiCA compliance signals commitment to regulatory standards |

| Product Expansion | Enables rollout of derivatives and additional offerings in Europe |

The MiCA license complements the MiFID II license, which Gemini was granted in May 2025, and allows the exchange to offer derivative products throughout the European Economic Area. With both licenses, Gemini is one of the most comprehensively regulated crypto exchanges operating in the EU.

Also Read: Crypto Marketing: Driving Growth in the Blockchain Industry

IPO Filing by Gemini, Nasdaq Listing Plans

On August 15-16, 2025, Gemini publicly filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission relating to a proposed initial public offering. It intends to list its Class A common stock on the Nasdaq Global Select Market under the ticker symbol GEMI.

Gemini Financial Performance H1 2025

| Financial Metric | H1 2025 | H1 2024 | Change |

|---|---|---|---|

| Net Loss | $282.5 million | $41.4 million | -582% |

| Revenue | $67.9 million | $73.5 million | -7.6% |

| Adjusted EBITDA | -$113.5 million | $32 million | -455% |

| Transaction Revenue (% of Total) | 65.5% | N/A | N/A |

Market Conditions: Cryptocurrency October 2025

Bitcoin Price and Market Analysis

As of October 1, 2025, Bitcoin is trading at about $112,000-$114,000. Analysts predict a number of scenarios for October 2025:

| Forecast Source | Projected Range | Key Factors |

|---|---|---|

| CoinCodex | $118,091 by month-end | +4.58% growth expected |

| Technical Analysis | $116,000-$125,000 | Breaking above short-term EMAs |

| Institutional Outlook | $128,000-$150,000 | Fed rate cuts and ETF inflows |

Historically, October has been a good month for Bitcoin and cryptocurrency markets, hence the nickname "Uptober" among traders. Since 2013, Bitcoin has averaged 22% returns in October, while November has produced even stronger gains of 46% on average.

Gemini Security Features and Insurance Coverage

Security remains paramount in cryptocurrency custody and trading. Gemini implements multiple layers of protection for user assets.

Custody Security Measures

| Security Type | Gemini Implementation |

|---|---|

| Cold Storage | 95% of assets stored offline |

| Multi-Signature Wallets | Required for large transactions |

| Two-Factor Authentication | Hardware key support available |

| SOC 2 Type II Certification | Third-party audited security controls |

| Insurance Coverage | $200 million for Gemini Custody |

The $200 million insurance coverage applies specifically to Gemini Custody and protects against theft from security breaches, hacks of Gemini's systems, or theft by Gemini employees.

The Strategies for Trading that Work for Risk Management

Whether trading on Gemini or using any cryptocurrency platform, implementing proper risk management is crucial.

Portfolio Allocation Framework

| Asset Type | Allocation | Purpose |

|---|---|---|

| Blue-Chip Cryptocurrencies (BTC, ETH) | 60% | Core holdings with established track records |

| Mid-Cap Altcoins | 30% | Growth potential with moderate risk |

| Experimental/High-Risk | 10% | Speculative positions for potential high returns |

Risk Mitigation Strategies

- Position Sizing: A single speculative asset should never take more than 5% of your portfolio.

- Stop Loss Orders: Set preset amounts where a sale will automatically occur on a stock or asset when that amount has been reached (usually 10% to 15%) below the initial purchase date.

- Dollar Cost Averaging: By investing a predetermined amount consistently (for example, every two weeks) To prevent attempting to predict movements in the marketplace.

- Diversification: Invest in a wide range of different types of assets, i.e., cryptocurrencies, blockchains, and Uses.

Trading on leverage involves a number of risks and considerations

Platforms advertising 30x leverage actually amplifies both your potential gains and losses. A 30x leveraged position means a movement of price against your position by 3.33% results in a 100% loss of initial capital. It follows that liquidation can happen suddenly during wild market swings, and funding rates and borrowing costs reduce profitability.

How to Evaluate Cryptocurrency Trading Platforms?

Before investing on any online platform, do your homework by verifying:

- Check to see if your local regulator has issued a license for the site to operate. You can do this by searching through regulatory agency sites (i.e., FINRA BrokerCheck www.brokercheck.print.com; SEC EDGAR database www.sec.gov; FinCEN www.fincen.gov).

- Review the security history of the site to determine if it has ever been compromised and/or lost client funds. For example, exchanges like Gemini build trust by providing information regarding their site's security practices.

- Consult multiple independent sources to compare opinions of others who have used the platform before deciding whether to invest. You may find recurring comments related to withdrawal issues, customer service problems, or hidden fees.

- Determine all of the fees associated with using the service, such as trading fee(s), withdrawal fee(s), deposit fee(s), etc. (Gemini's fees range between 0.50% and 3.99% depending on whether you are using ActiveTrader or the web/mobile versions.) Do the right research before investing in any online platform.

Cryptocurrency Trading: What to Expect

The cryptocurrency industry has continued to mature further, along with increased regulatory clarity, institutional adoption, and technological innovation. MiCA in Europe and the awaited Federal framework in the U.S. give much clearer guidelines over how exchanges and investors can operate. Traditional financial institutions increasingly offer custody, trading, and investment products for cryptocurrencies. Bitcoin and Ethereum spot ETFs drive institutional capital into cryptocurrency markets, with additional possible approvals from other assets. Emerging platforms like Etherions Faston Crypto and similar blockchain projects continue to expand the ecosystem, offering traders diverse options beyond established exchanges.

Conclusion

The crypto landscape is moving fast in 2025, and the routes to profitability for a trader are very different via Crypto30x.com and Gemini. Where Crypto30x.com deals in high-risk signals and speculative opportunities, Gemini represents regulated, secure, and transparent trading with formidable compliance. In a maturing market, including innovations such as the Smart Wallet and MiCA licensing, the right platform balances risk and security with a view to long-term goals. Smart decisions mean smarter gains.

FAQs for Crypto30x.com Gemini

Q. Is Gemini safe to trade in cryptocurrency?

A. Yes, Gemini is one of the most secure US-based exchanges. It utilizes 95% cold storage, multi-signature wallets, SOC 2 Type II certification, and $200 million custody insurance. It falls under the regulation of the New York Department of Financial Services.

Note: While spot trading and custody are secure, past issues, like the Earn program, for instance, remind users about extra risks related to lending products.

Q. What happened to the Gemini Earn program?

A. The Gemini Earn program was put on hold in November 2022 when partner Genesis's lending halted. Later on, both companies were charged with the SEC for selling unregistered securities. In March 2024, Gemini settled with NY regulators whereby they would provide refunds for at least $1.1 billion to earn users, along with a $37 million penalty. Currently, the Gemini Earn program is still suspended.

Q. How does the Gemini Smart Wallet do away with seed phrases?

A. Gemini Smart Wallet uses passkey technology with the combination of biometrics, such as FaceID/TouchID, instead of 12–24-word seed phrases.

Your private key stays safe in your device's secure enclave. No seed phrase means reduced phishing risk. Social recovery options allow account restoration without writing down the recovery words.

Q. What is a MiCA license, and why does it matter?

A. MiCA is the new, uniform crypto regulatory regime in the EU. A license under MiCA allows for an exchange to legally operate across all 27 EU countries via the process of regulatory passporting. It ensures:

- Strong consumer protections

- Standardized regulations

- More confidence and openness

Gemini has been pursuing MiCA expansion to offer regulated services across Europe.

Q. Can I Really Make 30× Returns Trading Cryptocurrency?

A. While extraordinary returns are theoretically possible, they come with extremely high risk. Most of the traders, especially those trading on margin, fail at making money. Any platform guaranteeing 30× returns is almost certainly fraudulent. Responsible traders focus on risk management, not unrealistic multipliers

Respond to this article with emojis