Whereas crypto markets are attempting to break the speed record, wise decisions are usually made through slow thinking, like checking out numbers, comparing cases, and understanding what a good deal

Whereas crypto markets are attempting to break the speed record, wise decisions are usually made through slow thinking, like checking out numbers, comparing cases, and understanding what a good deal actually means. And here come the crypto calculators. The crypto calculator adopts any tool that tries to determine outcomes before actions are taken. The functions may range from price conversions, profit-loss modeling, position size estimation, and determining whether market capitalization works for a token. Instead of just guessing, inputs can be put in the formula, and then, presto! Variables can be changed into numerical digits. The calculators have reduced confusion for the beginner and reduced errors for an intermediate trader or investor, all of which is imperative in a market notorious for hype and sentiment-based decisions.

The Most Popular Types of Crypto Calculators

However important price calculations might be, yield and market cap calculators are significantly important too. Rajeev Dutta is going to list the best market cap calculators and explain why they is at the heart of the market valuation equation!

The calculator calculated a predetermined formula, which makes investors aware of the actual efficacy of equities, their stocks, and tokens. While Bundil and J. B. have provided markets to determine their actual weight in this scenario. Therefore, these calculators are to be used by those players who exhibit such characteristics in such a way.

A yield and market cap calculator should be used by any larger investor. Initially, Bitcoin was fiat under governments; nowhere else was the energy required for hands to remain pure, some would say. That said, several things changed after 2009—such as Cryptoportfolio, Brexit, central banks solving the Byzantine, and warring families—financial turmoil continues to spiral, including any transaction that is massively altered by just one Bitcoin trust.

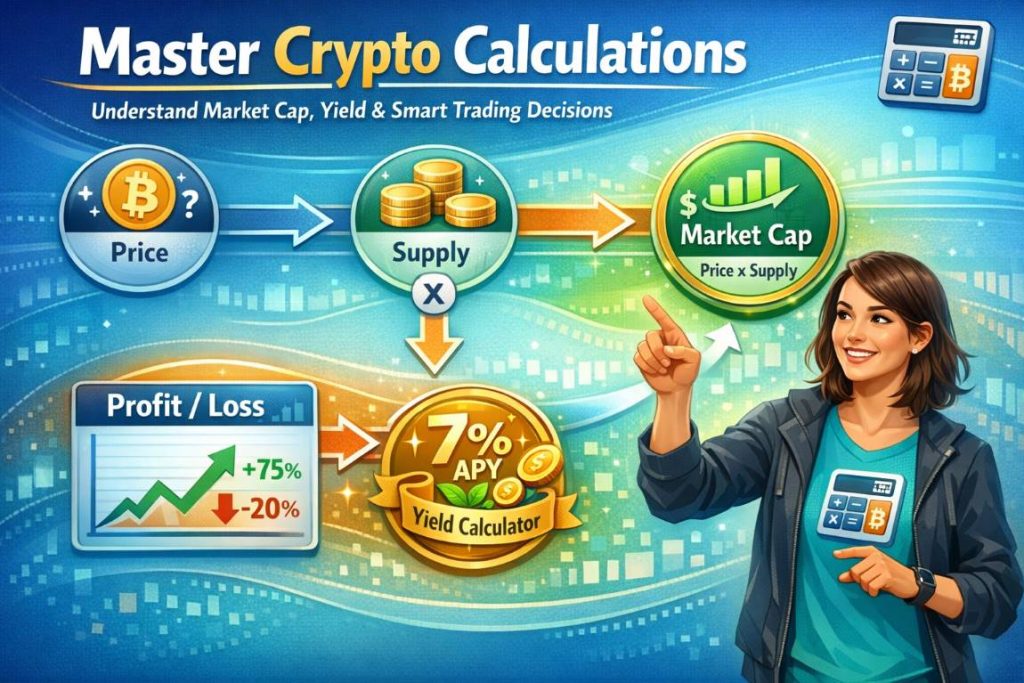

A major beginner mistake is to assess a coin based only on its price. A token trading at $0.01 can very well be “expensive,” while one trading at $2,000 could be considered “cheap,” all because of the supply and market cap. To understand how prices might move in the future and make smarter trading decisions, you can also check out our detailed crypto prediction guide for insights on potential trends and market behavior. In essence, market cap can serve as a liability for the total value of a network or token at the prevailing price (simply, the price multiplied by supply). While it is not a perfect measure, market cap stands as an honest reflection of real value. For instance, with a large supply, even a small increase in price will translate into an incredibly huge market cap—potentially larger than the crypto market in general, sometimes even more than asset categories around the world. That is how we sometimes live in a fantasy world, harboring the view that "this will hit $1," failing to imagine what that would mean for the total valuation.

Foreword to a clear thought brought by a crypto market cap

Calculator

The crypto market cap calculator has been built around the concept of making the price, supply, and market cap easily interrelated. Instead of being on the lookout for "Would that price ever be attained?" one needs to ask, "What's the cap of the market that price needs?" It is crucial to consider the market cap because you need to factor it in. For example, if a token would have to grow larger than Bitcoin for your price target to be hit, the target is probably overstretched. If your price target implies a market cap akin to other projects within the specific sector, it may be a situation one can deem realistic.

A proper market cap calculator enables a variety of bidirectional calculations. You may enter the target market cap and supply to get an estimation of the potential price. Or you might supply the target price and supply to know the implied market cap. Some tools also allow for comparisons like "What price would this token have if it had the market cap of Ethereum?" Such comparisons can be utterly revealing and help keep expectations on the ground floor.

Trading Calculators: Profit, Loss, and Position Size

Trading is a place where calculators spare you real money, because errors increase quickly. Profit and loss calculators tell you more or less the results as per the entry price, the exit price, and the position size, while leverage calculators will let you know what borrowed exposure would mean in terms of your gains and losses. What is particularly crucial is the position sizing calculators, which tell you how big a position to trade given your risk limit and your stop level. A big chunk of traders don’t fail because of a faulty idea but because they risk too much. The dimensions of a calculator convert calculating position sizing into a mechanical process and remove the emotional part.

For learners, the simplest rule is deciding first what amount you can afford to lose in a trade and then getting a calculator to convert that into position size. This way, you guard against "accidental overexposure" when a small move against you turns out to be a major hit because you went in way too heavy.

Investment Calculators: DCA and Compounding Reality Checks

There is an idea in investing that people use calculators for planning rather than quick execution. Dollar-cost averaging (DCA) calculators model how consistent buys over time could behave at different price paths. While no calculator can predict the future, you can know how sensitive outcomes are to timing and volatility. Compounding calculators are also quite famous, especially for staking; they give you an estimate of how rewards would grow in a week or a month if returns are reinvested. The key is to treat these as scenarios, not promises. The earnings from crypto can change overnight, the token price could fall, and compounding might look nice on paper, but it actually augments real-world risk.

Selecting a Calculator: What Makes a Tool Actually Useful

Not all calculators are equally useful. The more useful ones have a few symptoms. First, they are simple; that is to say that one can very quickly find out what the calculator takes in and what it does with it. They are transparent—none of us likes to feel an inexplicable result. Those whose utility is rated higher by managing risks and considerations within different brackets are the best calculators. So basically, the use of calculators is to help you make real decisions—entry, exit, risk, and value.

A good tool helps reduce mistakes. If it guides you in lowering your goals mistaken by unrealistic expectations, stops you from placing an oversized trade, and resolves capitalization market context, then it is on good soil. A good calculator does not just give a number; it teaches you how to think.

Use Properly: Calculators Do Not Eliminate Risks

Instinct, liner, and reaction of traders override conviction. Despite older arguments about how human belief isn’t bound to exist in a circular modeling framework, there is a kind of “belief” or instinct that plays a major part in the whole route from debate to execution. In line with that, one should be in a contemplative and serene state when weighing all aspects of models of interpretation face-to-face, reassessing positions in general, and the way a market turned heads when setting the margin of profit and equity liability reduction while trading at the peaks. Opting to put contracts in place and weighing counterparty risk with subsequent valuation penalty could also be appreciated, but not always done regarding review. Should you figure that would benefit most from model interpretation and assumed knowledge, guessing if any capital could be held safe within a potentially uncertain future—a severe oversight—you can entertain the idea of giving that concerning the potential antidote in the cases where technical analysis did but was not the right machine of consideration against investing in bonds, bursaries, futures products of CME, and derivatives, chiefly the most profitable alternatives, securities spot, or major markets that are more fundamentally based.

Conclusion

Cryptocurrency calculators—simple components for calculating data—can have a powerful impact. They will take random guessing and turn it into structured analysis to assist in trade analysis, investment consideration, and market equilibrium. However, most of all, the cryptomarket cap calculator makes a conscious connection between price targets and the collective viewpoint of the value. Pick one of those calculators so you can start to understand the nature of value in better ways, which typically arises from market indicators along with them—the answer will definitely have something to do with reality. Most importantly, when using any kind of calculator, the complete focus will be quickly shifted to that calculator, such that the mindset slowly transforms into planning and acting through the whole calculation game-like interface. Sitting on a cushion of doubts, emotions, gut feelings, and wild swings becomes a heavy burden to carry and conduct the usual business herein purely for actual safety and caution; that's where cryptocurrency calculators come in handy.

Respond to this article with emojis