What Is a Crypto Prediction? In the ever-changing world of cryptocurrencies, investors and traders are constantly seeking ways to anticipate market trends. A crypto prediction refers to the process of

What Is a Crypto Prediction?

In the ever-changing world of cryptocurrencies, investors and traders are constantly seeking ways to anticipate market trends. A crypto prediction refers to the process of forecasting the future price movements, adoption rates, and overall trajectory of digital assets based on various data-driven and analytical methods. These predictions are not mere guesses—they rely on historical data, technical indicators, macroeconomic analysis, and sentiment trends to estimate where the market might head next. In a volatile space where prices can swing by double digits in a single day, accurate crypto prediction models are invaluable tools for both retail and institutional participants.

Why Crypto Predictions Matter

Being open 24 hours and having operations on a worldwide platform is influenced by myriad factors—global regulations, new technological development, investor sentiment, or social media hype. Any kind of prediction, or, in reality, a reliable prediction, should help the trader weigh his/her options instead of reacting automatically to shifting developments in the market. For long-term investors, predictions tell them about exit and entry levels, while short-term speculations help to refine trading strategies. And the quality of the prediction becomes a blessing or a curse for a trader, making him either really rich or really poor within a few minutes or hours.

For stronger decision-making and reduced risk, you can also explore our guide on safe trading crypto signals to complement your prediction strategy.

The Science Behind Crypto Prediction Models

Modern-day crypto predicting techniques incorporate the latest and greatest technology, like machine learning, AI, or blockchain analytics. They try to analyze ever-growing datasets comprising trading volumes, price trends, order book depths, network activity, and on-chain data such as wallet movements or staking participations. Neural networks and deep learning-type algorithms are meant to find correlations among market events that cannot be found by mere human eyes. Also, some predictive models incorporate global economic indicators—lower or higher interest rates, inflation, and monetary policy, currently thought to have an increasing effect on cryptocurrency. Fundamental and technical analyses are combined by these models to give forecasts that are scientifically based and beyond mere speculation.

Technical Analysis and Cryptocurrency Predictions

Technical analysis is by far the most common method by which predictions in cryptocurrencies are made. The trader uses chart patterns, moving averages, volume indicators, and oscillators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to calculate the possibilities of a certain price direction. Buying and selling pressures can rise at various levels of support and resistance. Technical analysis can actually be quite effective in the crypto markets due to the psychological and speculative nature of price movements. It is, however, one method that offers a framework within which traders can understand price behavior and establish trends through forecasting.

Fundamental Analysis and Long-Term Forecasting

Short-term traders depend primarily on technical signals, whereas long-term investors consider fundamental analysis for crypto prediction. This entails a look at project utility, developer activity, tokenomics, partnerships, and network growth. For example, coins that have an application in the real world or provide some technological innovation tend to be much more sustainably developed. Regulatory development, institutional adoption, and world economic conditions further play an important role in shaping the sphere of future valuation. Long-term victories for the market are usually found when there is a strong blend of fundamental analysis fused with market sentiment.

Sentiment and Social Media Analytics

Sentiment analysis plays a key role in prediction accuracy in these present digital days. Market sentiment can change very fast by dint of social media platforms such as X (once known as Twitter), Reddit, and Telegram. Nowadays, algorithms can monitor millions of messages, posts, and comments simultaneously to determine investor sentiment. If a certain token suddenly enjoys a greater share of bullish tweets, such positive sentiment may lead to a price rally, whereas negative sentiment generally causes a price correction. By triangulating public sentiment alongside quantitative data, investors are able to form a more comprehensive picture of the market state.

Common Mistakes in Crypto Predictions

While data-driven forecasting is essential, one must remember the limitations of any given crypto prediction model. Misplaced concentration on short-term price indicators results in false signals. At the same time, not factoring in macroeconomic or regulatory developments clouds the long-term perspective. Other common pitfalls comprise acting on emotion: Decisions made in fear or greed, rather than logic. And no predictive algorithm would contend with unforeseen events such as exchange hacks, government bans, or black swan financial crises. Apart from very few, most traders would see applying these predictions as one of many tools, not as an established truth and the impact of AI and automation on crypto forecasting continues to grow.

Artificial intelligence has changed how predictions are made: AI-powered programs can take in torrents of market data—amounting to terabytes in a second—to recognize correlations and price patterns with almost absolute accuracy. A prediction by AI in crypto markets very often has a lesser degree of certainty in comparison with manual analysis in these complex markets. These models are continuously learning from fresh data and modifying their predictions due to evolving market situations. This, in essence, automates the reaction of traders and institutions to momentum shifts, giving these players an edge in the ever-varying market conditions.

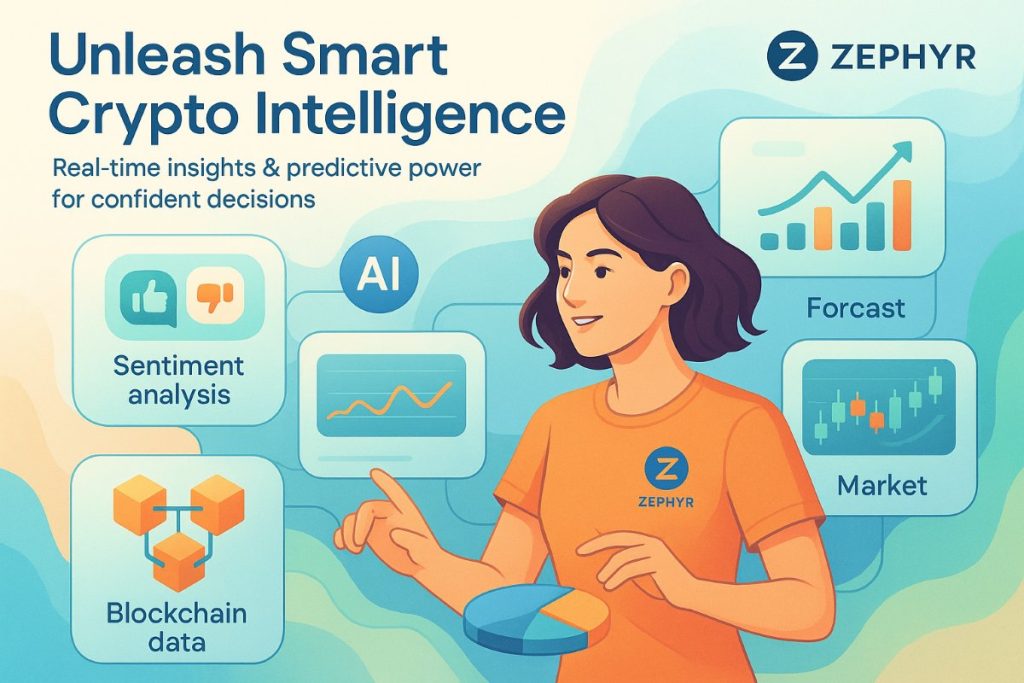

Introducing Zephyr—A Modern Take on Crypto Intelligence

Zephyr is an innovator when it comes to digital asset analysis and forecasting. Being a truly forefront platform, Zephyr leans towards an all-encompassing view of blockchain markets, crypto analytics, and digital marketing of Web3 projects. The technology relies on data science and artificial intelligence to empower its users with an understanding of the performance of market dynamics and the creation of smarter investment strategies. Zephyr does not just limit itself to predictions but also aids businesses within the crypto world in achieving better visibility, user engagement, and project credibility through a variety of data-driven campaigns.

How Zephyr Brings More Value into the Prediction Process in Crypto

Zephyr's dogma would be a unique mixture of analytics and marketing intelligence. It gathers and analyzes massive amounts of blockchain data so that investors and developers can track big trends and opportunities. Features like real-time data monitoring, sentiment analysis, or predictive modelling give users a leg up in anticipating market movements. Above all else, such a mentality of transparency coupled with technological precision could really do wonders for traders and projects buzzing away on the fast-evolving digital platform. Simultaneously, by interweaving quantitative research and inner value shoots sometimes, Zephyr basically sits on that limit between analytics and strategy so individuals and organizations can keep their heads above in this new crypto economy.

The Future of Crypto Predictions

As increased adoption of blockchain continues to grow, the need for working crypto prediction models will increase exponentially. Due to quantum computing, better AI algorithms, and decentralized data-sharing systems, the future will be that much better for actual foresight. Predictive analytics might soon find themselves on all crypto trading platforms, with the investor using real-time data to make trade decisions. Furthermore, cross-chain data aggregation will bring in an enhanced accuracy level by wrapping an entire picture of the whole crypto ecosystem. With platforms like Zephyr innovating farther into unknown territories, the future of forecasting in the digital assets space seems way more evolved and insightful.

Final Words

Most remarkable projects exist in the world of crypto assets. Accurate prediction, therefore, is at the heart of this new frontier. Great prediction spells a reduction in uncertainty and, hence, risk for traders, thereby allowing them to make financial decisions with more confidence. No model is perfect, however, and it is important to grasp that prediction is an equilibrium between abstract data-based analysis and real-world factors. Powered by an analytical platform like Zephyr, the crypto investing world is transforming into a smarter, informed, and strategic environment—a place where prediction meets precision and data meets opportunity.

Respond to this article with emojis