Generative AI tools based on large language models write, summarize, and analyze text or data. They are changing how finance teams work. Generative AI in Finance is not just a

Generative AI tools based on large language models write, summarize, and analyze text or data. They are changing how finance teams work. Generative AI in Finance is not just a trend — it’s redefining how organizations handle insights, compliance, and decision-making. Using digital tech in finance isn’t just about saving money: it means using data and automation to make smarter choices and find new ways to make money.

Finance teams are a good fit for Gen AI. They depend on data, need to be accurate, and have to move fast. They also work under strict rules. Let’s dive into how leaders can turn small digital wins into long-term change.

The market opportunity

In 2023, generative AI made $1.67 billion in the financial market. By 2030, it’s expected to hit $16 billion. It’s growing fast - about 39% each year. Fintech apps are growing too, from $888 million in 2022 to nearly $9.9 billion in 2030.

Many financial companies benefit from generative ai development services because they see a proven business value. About 63% of these companies already have AI working for them. There are five main ways AI adds value in finance:

- Automates tasks that take a lot of time.

- Makes data analysis faster and easier for better decisions.

- Helps create personalized customer experiences and new digital services.

- Lowers mistakes made by people and helps follow rules better.

- Helps build new kinds of business models.

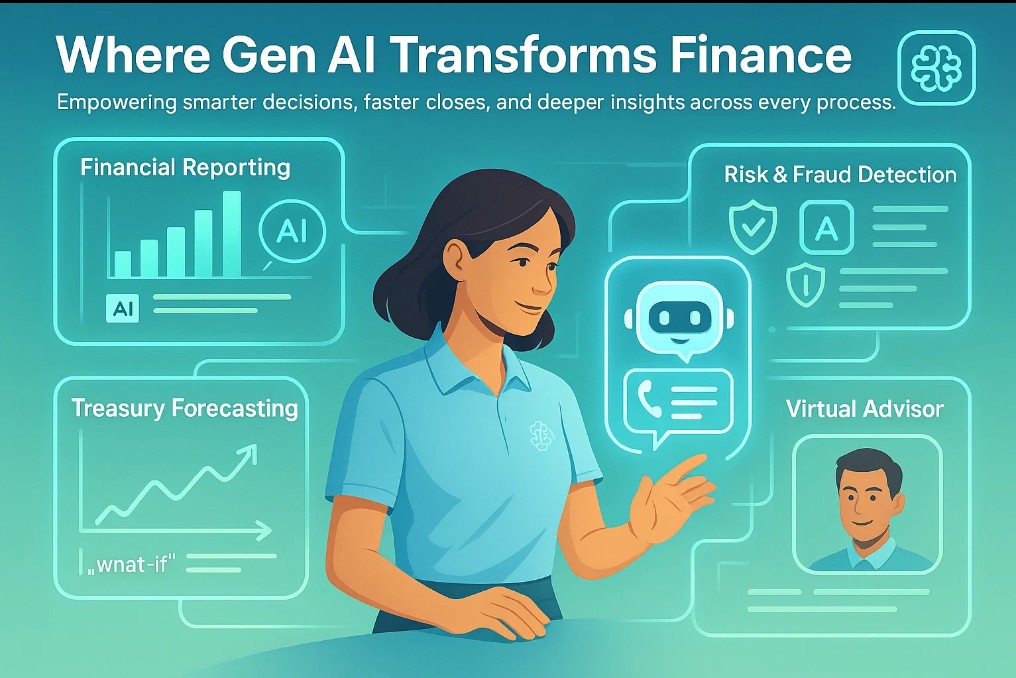

Where Gen AI is delivering impact

In areas such as reporting, compliance, treasury, and even customer engagement, Gen AI is enabling organizations to move from manual effort to intelligent automation and decision-making powered by insight.

Financial reporting and close

The challenge for organizations is that month-end close and reporting create wasted effort that involves repetitive data collection, document reviews, and writing commentary. Gen AI automatically generates summaries of financial data, drafts reports, and identifies inconsistencies or unusual transactions. As a result, organizations benefit from a faster close process, reduced errors, and more time for high-value analysis. For example, users of a Moody's AI assistant accessed 60% more data at 30% less time spent on a time-sensitive management task.

Risk, compliance, and fraud detection

Financial institutions have the responsibility of monitoring millions of transactions while also maintaining complex, compliance-heavy regulations such as Know Your Customer and Anti-Money Laundering. Gen AI is ideal for large datasets. It will automatically identify patterns, simulate a range of risk scenarios, and create reports for regulatory audits so that teams can stay ahead of fraud and compliance risks. Financial institutions benefit from stronger fraud detection, regulatory compliance execution, and operational cost savings. According to Grand View Research, Risk Management already constitutes 28.6% of Gen AI revenue in Financial Services.

Management of treasury and working capital

Forecasting and liquidity planning continues to be done in spreadsheets with manual entry, which is problematic for scale-ups and larger financial organizations. Gen AI models cash flows, forecasts "what-if" scenarios, and blends internal and external data everywhere for greater accuracy in forecasts and quicker decision-making.

ArXiv reported on a case study of a Gen AI-based "FinRobot" framework that resulted in a 40% reduction in processing time and a 94% reduction in error rates.

Customer engagement

Customers want and expect to receive the advice of their finances in real-time and personalized form, it is admittedly more difficult for most financial institutions to deliver this effectively. Gen AI powers chatbots counseling, virtual advisors, and personalized product recommendations that are very much first-line customer support and personalizing established needs. The net result is better engagement for credit unions, increased customer LTV along with higher engagement across other products.

Decision-making support in strategy

CFOs are looking for fast, data-driven insights when making strategic decisions. A plethora of data and disconnected databases holds back the speed of decision-making. Gen AI summarizes large data, creates forecasts, models financial scenarios to strip away from critical information, and suggests where to go from there.

22% of CFOs are exploring Gen AI and 4% are testing use cases in order to allocate capital quicker and smarter.

Automation through intelligence

Many finance processes - such as reconciliations and accounts payable - are still manual. Generative AI solutions plug into intelligent agents that can "think through" workflows and make context-based decisions. This takes finance ops from purely automation to true orchestration - allowing people to work on high-value analysis and strategy.

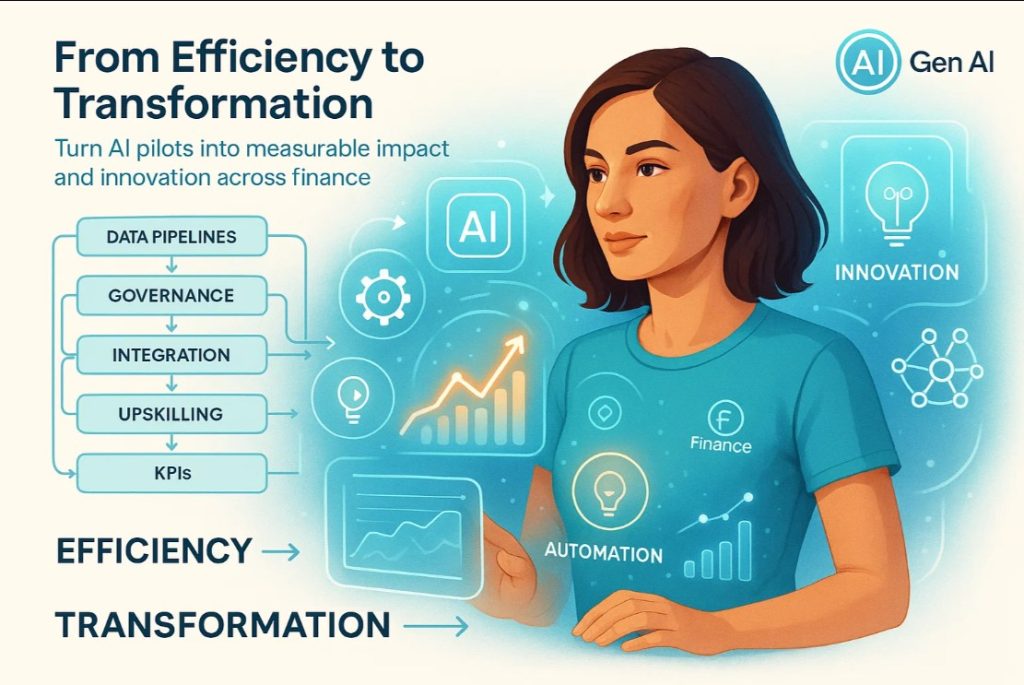

From efficiency to transformation

Nevertheless, a large number of organizations struggle to expand AI beyond pilot/test projects. McKinsey mentions that full enterprise-level transformation is still "nascent." Gen AI certainly can deliver value - but only when organizations flip the mindset. Do not start with AI - start with measurable outcomes. For a deeper look at how enterprises are building effective AI ecosystems, explore our post on generative AI solutions for AI development services.

Most organizations are beginning in the cost and time optimization - or automating current workflows. The greatest capability of Gen AI is to enable finance to transform itself into a proactive business partner.

This implies:

- Changing raw data into monetizable insights.

- Facilitating real-time decision-making.

- Promoting innovation organization-wide.

Key success enablers:

- High quality, well-governed data resources.

- Integration with existing finance systems and processes.

- Effective change management with trust in AI outputs.

Where to start with Gen AI in financial services

Success depends on strong leadership, ethical AI practices, and collaboration across teams.

- Pilot and scale successful projects from proof-of-concept to production.

- Build the foundation: invest in data pipelines, governance, and integration of workflows.

- Upskill your teams to effectively work with AI tools.

- Measure success: track KPIs like accuracy, time savings, and speed of decision making.

- Iterate and grow: continually evolve and scale what works.

What’s next for generative AI in finance

In the next several years, expect to see:

- AI models tailored explicitly for finance industries.

- Integration/compatibility between Gen AI and ERP systems.

- AI agents completing a financial task entirely independently of humans.

The paradigm may shift from automation to augmentation, where humans and AI work together to create value in richer insights and more informed decision making. To get there however, companies will need to have to consider things like data bias, model accuracy or inaccuracy, and compliance risk. Robust governance is going to be required. Those companies that get started with the opportunity will be at a lasting advantage over the competition.

Generative AI in finance isn’t just about doing things faster or cheaper - it’s about creating digital value in finance. The companies and leaders that position AI for strategic transformation will create finance functions that are smarter and more agile that fuel long-term growth. The future of finance will be AI augmented and now is the time to get going.

Respond to this article with emojis