Packaging used to sit in marketing; now it shapes the entire P&L. Carrier base rates are set to climb another 5.9 percent in 2025 according to the 2025 shipping rate

Packaging used to sit in marketing; now it shapes the entire P&L. Carrier base rates are set to climb another 5.9 percent in 2025 according to the 2025 shipping rate increase outlook, and 80 percent of shoppers now expect same-day options, according to Capital One Shopping. Any carton that wastes space—or fails a scan—adds cost, carbon, and lead time at every stop.

In the pages ahead, you’ll see how tier-1 brands shrink boxes, slash fuel, and speed orders. We’ll close with a checklist you can put to work today.

Why packaging became a supply-chain lever

Ten years ago, a box’s main job was shelf appeal. Today it has three tougher jobs:

- Shield the product from drops and jolts.

- Travel cheaply under tighter dimensional-weight rules.

- Leave the smallest possible carbon trace.

That wider brief pulled packaging out of marketing and onto the COO’s dashboard. Industry analyses from OpEx Society show it can account for up to 15 percent of landed cost when no one manages it.

Operations teams now follow a design-for-distribution mindset. The first question isn’t “Will customers love this box?” but “How will this box flow through robots, trailers, and doorsteps?” The answer steers size, board grade, label placement, and even ink that resists conveyor friction.

Logistics-ready packaging shares four traits: it matches standard pallet footprints, trims every unnecessary gram, survives 90-degree conveyor impacts, and presents a scannable label on at least two faces. Each detail influences pallet count, dimensional-weight fees, and sorter uptime.

In short, the humble carton has become infrastructure. Treat it that way and your network starts saving money, carbon, and time with a single move.

Cost efficiency: right-sizing pays first

Carriers price parcels by cubic inches, not sympathy.

As of August 18, 2025, FedEx and UPS round every fractional inch up before running the dimensional-weight (DIM) formula, so a box that measures 11.1″ becomes 12″ and can trigger a 40-pound billable minimum, according to analysis from Jay Group.

Those extra fractions appear as surcharges on the next invoice.

Amazon’s data makes the upside of tighter boxes hard to ignore.

By shipping more items in their own packaging, the company has cut average per-shipment packaging weight 43 percent since 2015, avoiding more than three million metric tons of material—savings that translate directly into freight spend.

The playbook is simple:

- Audit your top-velocity SKUs.

- Replace generic cartons with adjustable or on-demand cuts that hug the product.

Brands without an in-house packaging engineer can outsource the redesign.

Zenpack's logistics friendly custom packaging brings structural design, materials engineering, and freight logistics together, validating each dieline against FBA and retail specs so right-sized shippers arrive channel-compliant from day one.

Every trimmed cubic inch means lower DIM charges, less filler to buy, and one more pallet row of sellable goods.

Right-sizing remains the fastest, most visible win in the packaging toolkit.

Lower shipping and fuel costs: fill trucks, not empty space

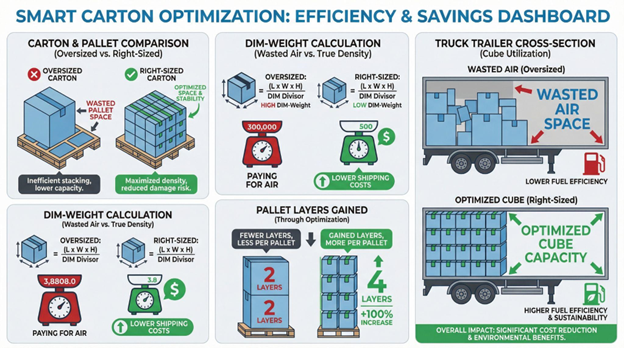

Right-sizing is only the first domino. Trailer cube utilization, the percentage of space you actually sell, jumps as cartons shrink. Chicago Consulting puts the upside at 5 to 15 percent of total logistics cost. A case documented by Zenpack, using its pallet-loading optimisation software, shows the effect in practice: after cartons were resized and pallet patterns re-planned, the shipper dropped from three ocean containers to two each month and saved about $5,000 in freight.

Trim box volume by 10 percent on a high-velocity item and you often gain a full extra layer on each pallet. Stretching across weekly lanes and a midsize shipper can eliminate multiple truckloads per quarter, turning ghost miles into hard savings and lower Scope 3 emissions.

Lighter, denser loads pay off in every mode. Air cargo skims under surcharge thresholds, ocean containers avoid overweight penalties, and last mile vans finish routes without a midday depot run. One packaging redesign touches every fuel line; that is compound interest for your freight budget.

Fewer damages, fewer returns

A cracked screen or dented corner costs twice: once to replace the product, again to pay for reverse logistics. Protective packaging breaks that cycle.

Case in point: a sofa manufacturer that swapped loose-fill for molded pulp inserts cut its transit damage rate from 15 percent to 2 percent—an 87 percent drop—saving about $85,000 a year in claims. Similar studies put the average cost of a single consumer return at $21 in handling and freight alone, according to Narvar research.

Fewer breakages ripple outward: less landfill waste, no “apology” shipments, and higher review scores that protect conversion rates. Packaging engineered for real-world impacts is not overhead; it is a margin safeguard that pays back on every mile the product travels.

Labor and handling savings

Manual carton building is slow. A skilled packer forms 5–7 boxes a minute; an automatic erector runs 15–30 without breaks. At $20 an hour, two workers assembling cartons cost roughly $83,000 a year on a single shift, while a $60,000 erector pays for itself in under 12 months.

That speed ripples through the line. When machines cut, fold, and seal the carton, pickers stay on task, overtime drops, and supervisors redeploy staff to quality checks instead of taping flaps. In the tight U.S. labor market, where packaging wages have climbed 8.7 percent annually since 2022, automation is payroll control.

Smart packaging choices—self-locking designs, right-sized blanks, on-demand cutters—turn head-count pressure into throughput headroom, letting the same crew clear peak volumes without extra shifts. Understanding what is material handling in the broader warehouse context helps operations teams integrate packaging automation with existing conveyor systems, robotics, and storage equipment for maximum efficiency.

Avoiding penalties and partner fees

Retailers are not referees for fun; they fine suppliers whose packaging clogs their systems. Amazon’s guidance is explicit: any non-compliant sortable that skips SIPP certification triggers a $1.99 chargeback per unit. A brand shipping 10,000 units a week would leak more than $19,000 before noticing the invoice.

Walmart’s Supply-Chain Standards impose up to $2.50 per case for oversized cartons or unreadable barcodes, and Target’s Vendor Scorecard deducts two percent of invoice value when packaging forces manual rework.

The cure is the same one that slashes freight bills: design for distribution. Right-sized, clearly labeled, curbside-recyclable cartons speed through inbound docks, dodge chargebacks, and keep partner relationships intact. Those silent wins appear on the P&L long after the shipment lands.

Sustainability

Packaging is the single-largest source of plastic waste worldwide: 40 percent of all discarded plastic in 2019 came from packaging alone, according to OECD data. Right-sizing and material swaps therefore punch far above their weight on your ESG scorecard.

Less material, less waste

Amazon’s SIOC program has eliminated more than three million metric tons of packaging since 2015 by trimming box volume and weight. Every gram you delete shows up twice: once on the procurement ledger, again on the waste audit.

Lower carbon per shipment

Smaller, lighter parcels mean denser truckloads. Chicago Consulting models show that a 10 percent cube reduction can cut lane-level CO₂ by seven to nine percent through cancelled truckloads. Multiply that across annual volume and packaging becomes an emissions lever equal to many fleet upgrades.

Recyclable and circular materials

Brands are swapping EPS and PVC for molded pulp and mono-material films that slide straight into curbside bins. Apple’s shift to fiber-based iPhone packaging avoided 861,000 metric tons of primary material in one product cycle—proof that performance and recyclability can coexist at scale.

Regulatory tailwinds and brand lift

Extended-producer-responsibility fees now apply in five U.S. states and every EU member. Non-compliant packaging can add $0.10 to $0.25 per unit in recovery charges, according to the Ellen MacArthur Foundation. Designing ahead of those rules turns future penalties into present-day wins: 72 percent of online shoppers say eco-friendly packaging makes them more likely to repurchase, based on Shopify’s 2024 Sustainability Survey.

In short, sustainable packaging is not a feel-good add-on; it is a measurable path to lighter ledgers, lighter trucks, and lighter landfills.

Speed and fulfillment efficiency

Streamlined warehouse handling

When every carton shares modular dimensions and a clear scan face, conveyors stay jam-free and robots grip confidently. Zebra Technologies measured a 12 percent throughput hit when barcodes sit on flaps or odd angles in high-speed sortation. Uniform, right-sized boxes cube neatly, ride straight down chutes, and cut inbound check-in time. The result: service-level promises become predictable beats instead of recovery sprints.

Faster packing and order fulfillment

Seconds matter on a pack line. Manual flap-folding averages four to six boxes a minute, while Packsize’s fully automated X6 produces up to 1,500 boxes an hour—one every 2.4 seconds. A European e-commerce customer boosted order throughput 30 percent without adding headcount after installing on-demand machines.

Improved delivery speed and last-mile density

Small, rectangular parcels slip into parcel lockers and mail slots, raising first-attempt delivery success. UPS data show a 23 percent re-delivery reduction when packages meet locker dimensions. Higher cube density also lets route planners pack more stops per van, trimming overtime on peak days. Amazon’s ship-in-own-container items bypass re-boxing, letting packages leave the fulfillment center three to five minutes sooner per unit.

Fewer errors, smoother compliance

Every out-of-spec carton triggers rework. Amazon’s ISTA 6A failure rate falls below 0.4 percent for Prep-Free certified items, versus 3 percent for non-certified SKUs. Prep-ready packaging skips the repack station, avoids the $1.99 penalty, and reaches the shelf with cleaner inventory data. Compliance is not bureaucracy; it is measurable velocity.

Tier-1 case snapshots

| Company | What they changed | Cost impact | Sustainability impact | Speed / efficiency impact |

| Amazon (e-commerce) | Frustration-Free / SIOC packaging that ships in product container | Cut average per-shipment packaging weight 43 percent since 2015, avoiding three million metric tons of material | Eliminated 446,000 metric tons of packaging in 2023; all FFP boxes are curbside-recyclable | Prep-free items skip re-boxing, leave facilities three to five minutes sooner per unit |

| IKEA (home retail) | Continuous flat-pack optimisation; standard pallet-friendly geometry | Saved €12 million in logistics cost in one year by fitting more units per pallet | Fewer sailings and high recycled-fibre share cut CO₂ across inbound lanes | Uniform cartons load quickly in automated DCs, speeding store replenishment |

| Apple (consumer electronics) | Smaller iPhone box, power adapter removed, fibre inserts | 70 percent more phones per pallet, trimming freight spend | Avoided 861,000 metric tons of raw material in one product cycle | Smaller, sturdier boxes travel securely, supporting rapid global launch dates |

Emerging trends to watch

AI-driven packaging design

Cloud platforms such as PackDigit and Altair’s Inspire Print3D now ingest CAD files and historical shipping data, then output right-sized box specs that cut cube eight to fifteen percent on pilot SKUs. Engineers skip weeks of prototyping, and the software projects carbon and material savings before the first die-cut.

On-demand and automated packaging systems

Packsize’s X7 produces a right-sized box every 3.5 seconds, or 1,020 boxes an hour, with no manual taping. Customers report labor savings above 30 percent in the first peak season after installation.

Smart and connected packaging

UHF RFID tags now cost under four cents at 500 k volumes, opening item-level tracking for everyday consumer goods. Real-time shock or temperature data cuts quality-assurance cycle time and feeds redesign loops that trim damage claims.

Innovative materials for sustainability and performance

Mycelium-grown inserts from Ecovative compost in 45 days at home and meet Dell’s drop-test spec, replacing EPS in more than one million shipments to date. For a step-by-step roadmap to adopting similarly eco-engineered solutions, see this five-step guide to sustainable brand packaging.

Ultra-thin high-strength corrugate cuts fiber use by 30 percent while matching legacy crush ratings.

Returnable packaging and loop systems

CHEP’s pooled IBC or tote models spread purchase cost across 60 to 100 trips, driving unit-packaging costs 60 percent lower than single-use corrugate in closed B2B loops. QR-code check-ins automate deposit refunds and inventory visibility.

Regulatory and compliance developments

California SB-54 will collect $5 billion in producer fees and mandate recyclability for 100 percent of packaging by 2032. EU PPWR drafts propose a 15 percent empty-space cap on e-commerce parcels by 2030. Designing ahead turns tomorrow’s fine into today’s marketing headline.

Action checklist for supply-chain leaders

- Audit your top 20 products by ship volume. Log carton-to-product cube percentage, DIM fees, and damage rate for each. McKinsey finds the first 20 SKUs often drive 60 percent of parcel spend.

- Prototype one right-sized or automated solution each quarter. Run a four-week A/B lane test and require at least a ten percent freight or labor improvement to move forward.

- Build compliance from day one. Map Amazon SIOC, Walmart ISTA 6, and local EPR rules into the CAD brief so packaging clears every gate without the $1.99 chargeback.

- Pair finance with sustainability. Report cost per unit and kilograms of carbon dioxide equivalent saved; projects that hit both metrics clear CapEx committees 30 percent faster.

- Hold a quarterly packaging review. SKUs change and penalties evolve. A cross-functional “Box Board” reviews metrics and refreshes specs, keeping the P&L and the carbon ledger trending down.

Conclusion

Packaging is not décor; it is operational infrastructure. Brands that right-size, automate, and certify their cartons cut unit freight up to 15 percent, trim Scope 3 carbon by high single digits, and hit carrier cut-offs with minutes to spare.

Amazon, IKEA, and Apple prove the upside. Your next pallet can, too. Treat every cubic inch like a budget, every gram like carbon, and review the numbers each quarter. Optimize, measure, repeat. When you do, the rest of the supply chain will keep pace.

FAQs for Logistics-Friendly Packaging

1. Why is packaging now a supply-chain priority instead of a marketing afterthought?

Packaging affects freight cost, damage rates, automation performance, retailer compliance, and carbon footprint. As carriers tighten dimensional-weight (DIM) rules and shoppers demand faster delivery, packaging choices now influence the entire P&L.

2. How does right-sizing packaging reduce costs?

Carriers charge based on volume, not weight. Because FedEx and UPS round fractional inches up, even small oversizing can trigger higher DIM fees. Right-sizing cuts billable weight, reduces filler, and increases pallet density, delivering the fastest payback of any packaging optimization step.

3. How much can right-sizing actually save on freight?

Industry benchmarks show 5–15% total logistics savings. Shrinking box volume improves trailer cube utilization, reduces truckloads, and lowers air/ocean surcharges. Amazon’s SIOC program has cut average packaging weight 43% since 2015.

4. How does logistics-friendly packaging help reduce product damage?

Engineered inserts (e.g., molded pulp) and stronger structural designs absorb impacts and eliminate void space. Brands often cut damage rates 70–90%, reducing returns, replacement shipments, and landfill waste.

5. What role does automation play in packaging cost and speed?

Manual box building averages 5–7 boxes/minute; automated erectors hit 15–30. On-demand machines like Packsize’s X6/X7 can exceed 1,000 boxes/hour. Automation lowers labor spend, boosts throughput, and avoids overtime—critical as packaging wages rise.

6. How does optimized packaging improve fulfillment and delivery speed?

Right-sized, uniform cartons:

- Flow smoothly through conveyors and robotics

- Reduce barcode-scan failures

- Improve first-attempt delivery success

- Pack more stops per van in last mile

Together, these produce faster order cycle times and more predictable SLAs.

Respond to this article with emojis