A VASP license formally authorises a company to provide services involving virtual or digital assets, including custody, exchange, fiat/crypto conversion, and transfer operations. It verifies compliance with AML/CFT obligations, adherence

A VASP license formally authorises a company to provide services involving virtual or digital assets, including custody, exchange, fiat/crypto conversion, and transfer operations. It verifies compliance with AML/CFT obligations, adherence to the Travel Rule, robust governance, and effective risk management and cybersecurity standards.

In the European Union, the MiCA Regulation introduces the CASP (Crypto-Asset Service Provider) regime in 2025. While terminology differs (VASP vs CASP), both aim to protect investors, preserve market integrity, and prevent money laundering in line with FATF standards and the EU’s 5AMLD. Holding valid authorisation enhances credibility with banks and payment partners, reducing the risk of service disruptions due to non-compliance.

Globally, similar frameworks exist under different names: the UAE’s VARA (Dubai) and ADGM (Abu Dhabi), Switzerland’s FINMA, Singapore’s MAS PSA (Payment Services Act), Hong Kong’s SFC VATP, the UK’s FCA registration, and Finland’s FIN-FSA oversight. Each follows FATF guidance on AML/KYC frameworks, risk management, and reporting obligations.

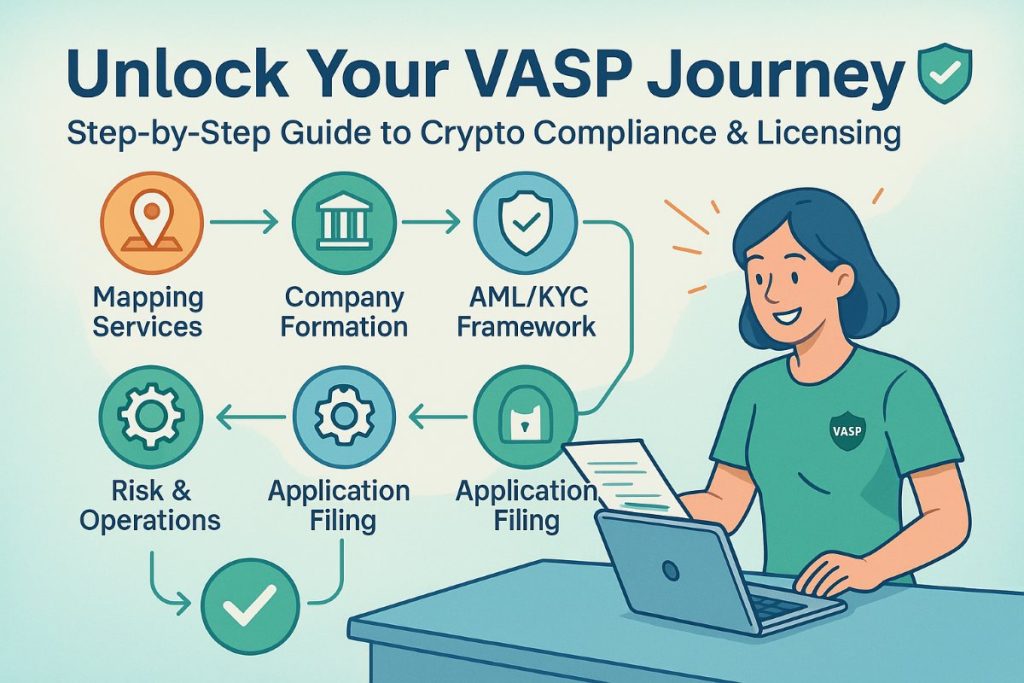

How to Get a VASP License: Step-by-Step

1. Map Services and Choose Jurisdiction

- Define your services (exchange, custody, payments, brokerage).Many licensed VASP companies now offer fiat-to-crypto conversion using Visa or MasterCard. You can explore the process in this Dogecoin Visa & MasterCard integration guide

- Compare jurisdictions based on timelines, costs, and banking access.

- Confirm whether you need VASP registration or another type of authorisation (e.g., MAS PSA).

2. Company Formation and Governance

- Incorporate the entity and appoint directors, Compliance Officer/MLRO, and key roles.

- Ensure local substance if required (resident directors, physical office, audited accounts).

- In Estonia, leverage the E-Residency program for efficient setup.

3. Draft AML/KYC Framework and Compliance Program

- Align with FATF, 5AMLD, and local guidance.

- Implement Travel Rule procedures and select compliant vendors.

- Maintain training, recordkeeping, and audit readiness.

4. Risk and Operations

- Establish risk management covering liquidity, operational, and technology risks.

- Segregate client assets and ensure reconciliation.

- Demonstrate capital adequacy per local laws.

5. Technology and Cybersecurity

- Document security architecture (key management, encryption, penetration testing).

- Assess third-party risk for Travel Rule, custody, and analytics vendors.

6. Application Preparation and Filing

- Draft business plan, compliance documents, and fit-and-proper forms.

- Submit application and respond to regulator queries.

- Engage with local regulators (e.g., FIU in Estonia, FIN-FSA in Finland, VARA in UAE, FINMA in Switzerland).

7. Pre-Launch and Approval

- Address regulator feedback, finalise staffing, and implement systems.

- Obtain authorisation and launch within approved scope.

Snapshot: Leading Crypto Jurisdictions in 2025

| Jurisdiction | Regime / Authority | Time to Approve | Capital / Adequacy | Passporting | Notes |

| EU (Estonia) | CASP under MiCA / FIU | 4–8 months | Proof of capital adequacy | Yes | Digital ecosystem; E-Residency benefits |

| EU (Finland) | CASP / FIN-FSA | 6–10 months | Risk-based capital | Yes | Conservative, strong bank ties |

| Switzerland | VASP-equivalent / FINMA | 6–12 months | High substance, strict AML | No | Excellent banking access |

| UAE (Dubai) | VARA | 6–12 months | Activity-based | No | Tiered licensing structure |

| UAE (Abu Dhabi) | ADGM / FSRA | 6–12 months | Risk-based | No | Institutional-grade environment |

| United Kingdom | FCA AML Registration | 6–12+ months | Robust systems | No | Strong credibility |

| Singapore | MAS PSA | 9–15+ months | Capital + risk controls | No | Regional hub with strict standards |

| Hong Kong | SFC VATP | 9–15+ months | Investor safeguards | No | Retail access under conditions |

Why Choose RUE

RUE is an Estonian legal consultancy assisting companies with VASP, CASP, and related licenses worldwide.

- Trusted by 500+ teams: Exchanges, custodians, and PSPs.

- Strategic clarity in 7–10 days: Jurisdiction shortlist with cost and timeline insights.

- End-to-end execution: Incorporation, governance, documentation, and regulator liaison.

- Compliance built-in: Travel Rule tools, AML/KYC, and cybersecurity frameworks.

- Transparent pricing: Fixed-fee, milestone-based model.

- Ongoing support: Reporting, monitoring, and updates.

Key Takeaways

- A VASP license builds banking and institutional trust.

- In the EU, MiCA establishes CASP in 2025 with EU passporting.

- Compare UAE, Switzerland, Singapore, and Hong Kong for non-EU options.

- Success depends on AML/KYC depth, cybersecurity, and capital adequacy.

- Post-license compliance ensures long-term credibility and regulatory alignment.

Respond to this article with emojis