In today's fast-paced business environment, efficient revenue cycle management is paramount for the financial health and sustainability of any organization. For many firms, particularly those in service industries, the billing

In today's fast-paced business environment, efficient revenue cycle management is paramount for the financial health and sustainability of any organization. For many firms, particularly those in service industries, the billing process often stands as a bottleneck, consuming valuable resources and leading to potential delays in cash flow. This is where billing automation services emerge as a critical solution, offering a pathway to optimized operations and improved financial outcomes. Embracing these services is not just about adopting new technology; it's about fundamentally rethinking and enhancing how revenue is generated and collected.

A comprehensive overview of billing automation

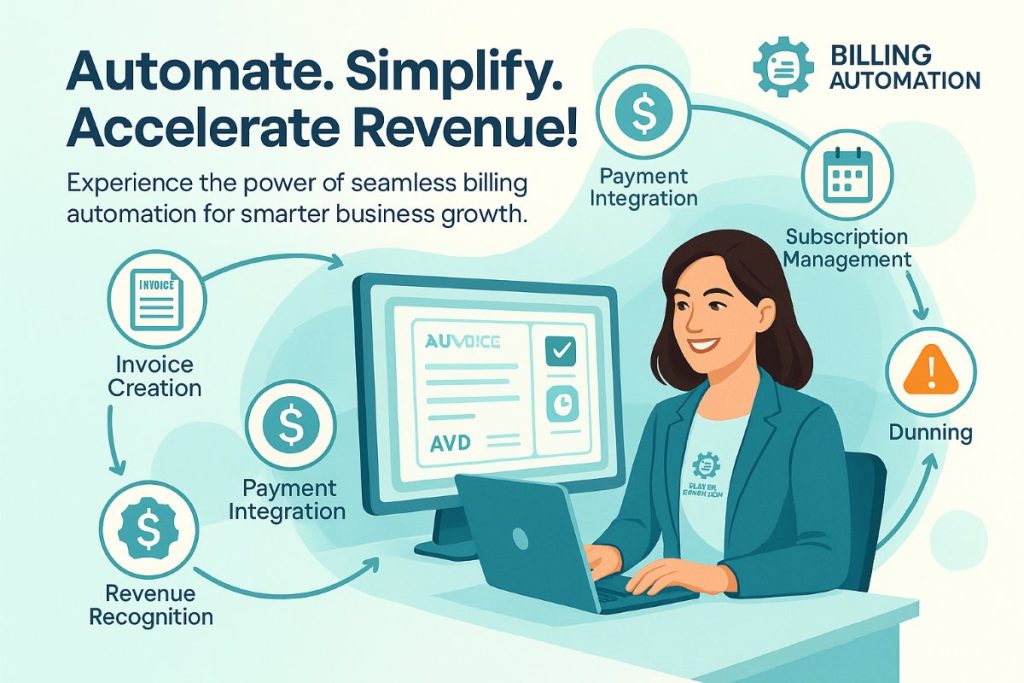

Billing automation refers to the use of technology to streamline and automate various aspects of the invoicing and payment collection process. This extends far beyond simply generating invoices, encompassing everything from client onboarding to payment reconciliation. The overarching goal is to reduce manual effort, minimize errors, and accelerate the revenue cycle, ensuring timely and accurate cash flow for the business.

What constitutes billing automation?

Essentially, billing automation involves leveraging specialized software and integrated systems to automate repetitive and rule-based tasks within the billing lifecycle. This includes creating and sending invoices, tracking payment statuses, dispatching payment reminders, and even automatically processing recurring payments. Sophisticated systems can also manage subscription models, proration, and complex pricing structures, adapting to diverse business needs.

Key components of an effective billing automation service

A robust billing automation service typically includes several integrated features designed to provide end-to-end support for the revenue cycle. These components work in concert to ensure efficiency and accuracy:

- Automated invoice generation

- Payment processing integration

- Subscription and recurring billing management

- Dunning management

- Revenue recognition

- Reporting and analytics

The undeniable advantages of integrating billing automation

Implementing a billing automation service offers a transformative impact on a business's operational efficiency and financial stability. The benefits span across various organizational functions, making it a strategic investment for growth-oriented companies.

Accelerated cash flow and improved liquidity

One of the most immediate and impactful benefits is the significant acceleration of cash flow. By automating invoice delivery and payment reminders, businesses can drastically reduce the time it takes to get paid. This improvement in the accounts receivable cycle directly enhances liquidity, providing the capital needed for operations and growth initiatives. Faster collections mean a healthier balance sheet and greater financial flexibility.

To understand how automation and digital transformation can further enhance your business operations, explore our article on The Role of B2B Ecommerce for Modern Enterprise

Dramatically reduced manual errors

Manual billing processes are notoriously susceptible to human error, which can lead to incorrect invoices, delayed payments, and strained client relationships. Automation eliminates these risks by ensuring consistency and accuracy in every transaction. Error reduction translates to fewer disputes and a more reliable revenue stream, safeguarding profitability.

Substantial operational cost savings

The time and resources traditionally allocated to manual billing tasks can be substantial. By automating these processes, firms can significantly reduce labor costs and reallocate staff to more strategic, value-adding activities. The efficiency gains also minimize the need for extensive training and oversight, further contributing to cost reductions. Operational efficiency directly impacts the bottom line.

Enhanced customer satisfaction and retention

Accurate and timely billing contributes significantly to a positive customer experience. Automated systems ensure clients receive correct invoices promptly and offer convenient payment options. This professionalism builds trust and strengthens client relationships, leading to higher satisfaction and improved retention rates. A smooth billing experience is a key differentiator.

Greater transparency and financial visibility

Automated billing systems provide comprehensive reporting and analytics capabilities, offering real-time insights into billing performance, payment trends, and outstanding receivables. This increased transparency allows management to make data-driven decisions and better forecast financial health. Improved visibility is crucial for strategic planning and risk mitigation.

Strategic considerations for adopting billing automation

While the benefits are clear, successful adoption of billing automation requires careful planning and execution. A thoughtful approach ensures seamless integration and maximizes the return on investment.

Assessing your current billing processes

Before implementing any new system, thoroughly evaluate your existing billing workflows. Identify pain points, bottlenecks, and areas where manual effort is concentrated. Understanding these challenges will help you pinpoint the most critical areas for automation and select a solution that directly addresses your needs. A detailed process audit is the foundational step.

Choosing the right automation partner

Selecting a billing automation service provider involves more than just comparing features. Consider the vendor's experience, their integration capabilities with your existing CRM and accounting software, scalability, security protocols, and the quality of customer support. A reliable partner will offer a solution that grows with your business and provides ongoing assistance. Partnership quality is paramount for long-term success.

👉Businesses looking to enhance their billing efficiency can also explore the benefits of cloud accounting software, which complements billing automation services by providing real-time access, secure data handling, and seamless workflow integration.

Phased implementation and staff training

Rather than an abrupt transition, consider a phased implementation approach. Start with a smaller scope, get accustomed to the new system, and then gradually expand its use across your organization. Comprehensive training for your staff is also essential to ensure they are comfortable and proficient with the new tools, fostering a smooth transition and maximizing adoption. Effective change management is key to successful deployment.

The future of revenue management

The trend towards sophisticated billing automation is only set to accelerate. Businesses that embrace these technologies now will be better positioned for future growth and competitive advantage. The future of revenue management is smart, seamless, and automated.

Leveraging AI and machine learning in billing

Advancements in AI and machine learning are continually enhancing billing automation capabilities. These technologies can optimize pricing strategies, predict payment delays, and even personalize dunning processes, further improving efficiency and effectiveness. AI integration will unlock new levels of precision and foresight.

Seamless integration with broader financial systems

The true power of billing automation is realized when it is seamlessly integrated with other financial and operational systems, such as general ledger, CRM, and ERP. This holistic approach creates a unified ecosystem that provides a complete view of financial operations, enabling superior decision-making. Interconnected systems drive ultimate efficiency.

By strategically adopting and integrating a comprehensive billing automation service, businesses can transform their revenue cycle from a source of friction into a smooth, efficient, and highly profitable engine for growth.

Respond to this article with emojis